Odoo GST e-Invoicing System

Easily File GST e-Invoice by uploading JSON directly in Odoo!!

- Prepare invoice reports in Odoo for filing GST.

- Generate the summary quarterly as well as monthly periods.

- Generate the summary directly from the Odoo invoices as well.

- Upload the response of GST e-Invoice.

- Get Detailed Information About GST e-Invoice response on Invoice report.

- Manage GST e-Invoice state for better tracking.

- Prepare the valid JSON for GST e-Invoice.

- Share the mail to the customers via email notifications.

- Description

- Reviews

- FAQ

- Customers ()

- Specifications

- Cloud Hosting

- Changelog

Odoo GST e-Invoicing System - What is GST?

Goods and Services Tax is an indirect tax used in India on the supply of goods and services. It is a comprehensive, multistage, destination-based tax because it has subsumed almost all the indirect taxes except a few state taxes.

Receive a simplified Invoice to file GST in Odoo!!

Odoo GST e-Invoicing System Offline Tool allows you to get the Simplified Invoice Summary in JSON format and upload it to file GST E-Invoice portal manually.

Indian Accounting follows the GST (Goods Services Tax); hence, filing GST is necessary for business owners in Indian Market. For filing the GST e-Invoice, you have to fill the form manually or upload the JSON format of the details.

As we know, JSON is not a human-readable document. However, a human-readable invoice report is needed to track your business details.

With this module, you can file your GST e-Invoice in quick and easy steps. Hence, uploading JSON to file GST e-Invoice can help you make the process quick and easy. Also, Time is precious, and you can save it by receiving a simplified format of your GST invoice.

Prerequisites For Using Odoo GST e-Invoicing System Module

Odoo GST e-Invoicing System works in conjunction with the following module:

Odoo GST - Returns and Invoices

Firstly, you must install this module for Odoo GST e-Invoicing System to work perfectly.

Odoo GST e-Invoicing System Features

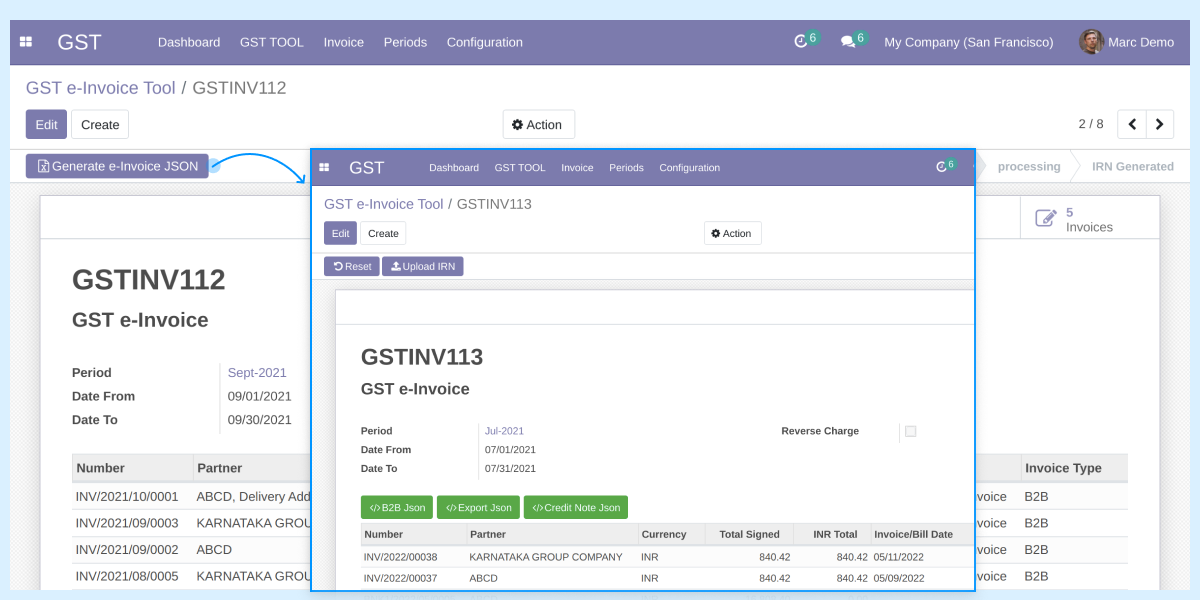

Generate Summary for GST e-Invoice

- The modules enables you to generate JSON format for B2B, Export and Credit Note with a single click.

- You can generate the summary quarterly as well as monthly periods.

- You can also generate the summary directly from the Odoo invoices as well.

Upload the response of GST e-Invoice

- Upload CSV of GST e-Invoice summary response in a single place.

- You can also upload CSV of GST e-Invoice summary response directly from the Odoo invoices as well.

- You can also manually update the GST e-Invoice summary response directly from the Odoo invoices as well.

Get Detailed Information About GST e-Invoice response on Invoice report

- You can view detailed information about GST e-Invoice response.

- Information like(Acknowledgement Number, Acknowledgement Date, Invoice Reference Number(IRN), Qrcode) from customer invoices.

Manage GST e-Invoice state for better tracking

- You can check the status of GST e-Invoice status directly from the invoices.

Prepare the valid JSON for GST e-Invoice

- Odoo GST e-Invoice module come up with the all validation of the data which is used to prepare the GST e-Invoice.

Share mails with customers via Email notifications

- Odoo GST e-Invoicing System can help to share the mail to the customers who's invoices are in a paid state and IRN generated as well.

Set The Module From The Odoo Backend

- Odoo GST e-Invoicing System Offline Tool allows you to get the Simplified Invoice Summary in JSON format and upload it to file GST E-Invoice portal manually.

- Prepare invoice reports in Odoo for filing GST.

- Generate the summary quarterly as well as monthly periods.

- Generate the summary directly from the Odoo invoices as well.

- Upload the response of GST e-Invoice.

- Get Detailed Information About GST e-Invoice response on Invoice report.

- Manage GST e-Invoice state for better tracking.

- Prepare the valid JSON for GST e-Invoice.

- Share the mail to the customers via email notifications.

Generate JSON format to upload directly

- The modules enables you to generate JSON format for B2B, Export and Credit Note with a single click.

- You can generate the summary quarterly as well as monthly periods.

- You can also generate the summary directly from the Odoo invoices as well.

- Upload CSV of GST e-Invoice summary response in a single place.

- You can also upload CSV of GST e-Invoice summary response directly from the Odoo invoices as well.

- You can also manually update the GST e-Invoice summary response directly from the Odoo invoices as well.

- With this module, you can file your GST e-Invoice in quick and easy steps.

- Hence, uploading JSON to file GST e-Invoice can help you make the process quick and easy.

- Also, Time is precious, and you can save it by receiving a simplified format of your GST invoice.

Other Odoo Apps-

Odoo GST e-Invoicing System-

Webkul's dedicated support provides you with the customizations and troubleshooting solutions for Odoo GST e-Invoicing System.

For any query or issue please CREATE A TICKET HERE

You may also check our other top-quality Odoo Modules.

Specifications

Move to Cloud Today

AWS Free tier hosting for one year by amazon web services, for more details please visit AWS Free Tier.

GCP Free tier hosting for one year with 300 credit points by google cloud platform, for more details please visit GCP Free Tier.

Azure free tier hosting for one year with 25+ always free services, for more details please visit Azure Free Tier.

In our default configuration we will provide tremendous configuration for your eCommerce Website which is fast to load and response.

Default Configuration Details of Server

- 1 GB RAM

- 1 Core Processor

- 30 GB Hard Disk

- DB with 1 GB RAM and 1 Core Processor

* Server Configuration may vary as per application requirements.

Want to know more how exactly we are going to power up your eCommerce Website with Cloud to fasten up your store. Please visit the Cloudkul Services.

Get Started with Cloud