Top Selling Extension Winner

2 times in a row

Multi Vendor Avalara Tax for Magento 2

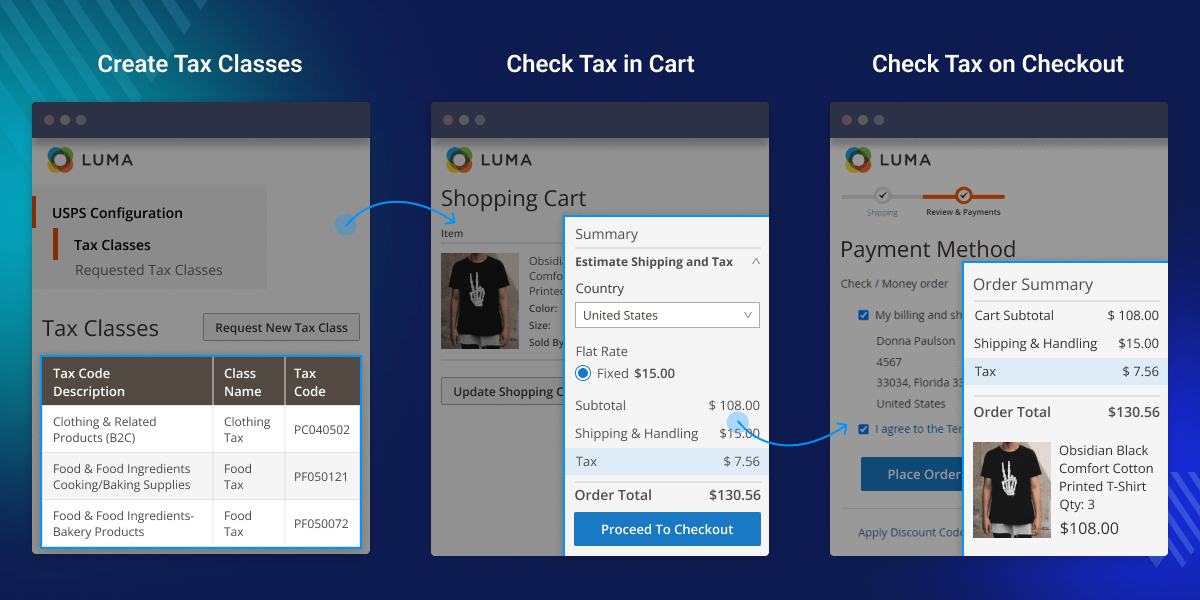

Multi Vendor Avalara Tax for Magento 2 allows the admin and vendors to create product tax classes using Avalara tax codes and enable customers to check tax based on the address.

- Calculate tax on the cart page as well as the checkout page using Avalara Avatax.

- Checks for the valid shipping address.

- The admin can create product tax classes with Avalara tax codes.

- The admin can directly apply tax class to the products in his store.

- The seller can see tax classes on his/her end.

- The seller can request a separate tax class with a tax code from his/her end.

- The seller can apply tax class approved by the admin to his/her products.

- The admin can approve/disapprove tax class requests.

- GraphQL has been implemented for the extension.

Top Selling Extension Winner

2 times in a row

- Description

- Reviews

- FAQ

- Customers ()

- Specifications

- Cloud Hosting

- Changelog

Multi Vendor Avalara Tax for Magento 2: Now integrate Avalara tax solution in Magento 2 Marketplace and calculate tax accurately. The store admin and marketplace sellers can create product tax classes using Avalara tax codes and enable customers to check tax based on the address. The sellers can also send a request to the admin for a separate tax class.

Allowing store owners to sell globally at the same time managing all your cross border tax calculation for products ordered from different jurisdictions across the world. Import taxes in real-time at the point of sale and collect at the time of checkout.

Please Note - This is a marketplace add-on, so you must install Webkul's Magento 2 Marketplace Module first.

Highlighted Features

Sell Across Globe

Avalara simplifies mapping tax classes to the required products with specific tax codes thus calculating accurate sales taxes for all the customers located anywhere.

Validate Tax

A user can validate the tax under their origin or primary business location and add more regions later on.

Allow Specific Countries

Admin can choose specific countries and the tax will be applicable to those countries only.

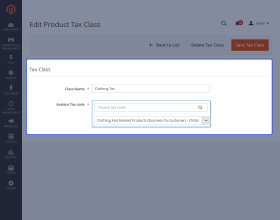

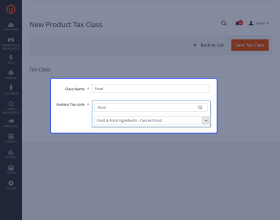

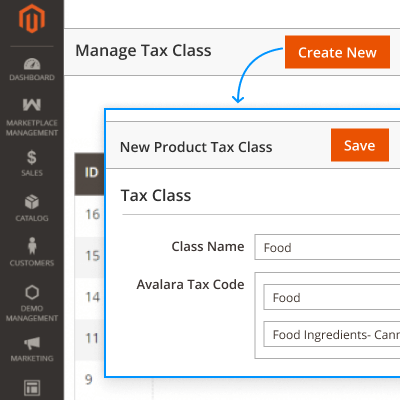

Create and Edit Product Tax Class

The admin can create product tax classes using Avalara tax codes and enter a suitable name for it.

Request Separate Tax Cass

The seller can request a separate tax class with a tax code from his/her end.

GraphQL Implemented

GraphQL has been implemented for the Multi Vendor Avalara Tax for Magento 2 extension.

Why Integrate Avalara Tax Solution into Magento 2 Multi Vendor Marketplace?

When you are selling globally it becomes difficult for the store owner to manage all the tax calculations. Since different countries and the regions within it may not necessarily have an adjacent or a similar tax system on top of it any change in the government tax policies could risk business and can cost penalties.

This module has an automated tax compliance system and any changes in the government tax system are reflected in your online store so the store owners don't need to be a tax expert.

Integrate Avalara Tax in Magento 2 Marketplace

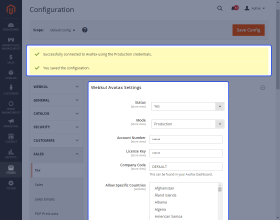

The admin can configure the module by integrating an Avalara account with Webkul Avatax settings.

- Admin can enable or disable the module.

- Can switch from development to production mode easily.

- Admin can allow specific countries and tax will be applicable to those only.

- Once configured, Avalara credentials will be saved and the users don't have to generate credentials again.

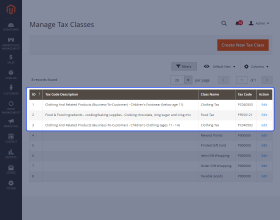

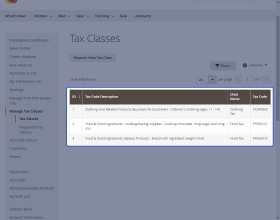

Manage and Create Tax Classes

The admin can view all the tax classes under one complete list and manage all the tax classes.

- A separate tax code makes it easier to distinguish between two tax classes.

- The tax code description section makes it further clear what the imported tax class is about.

- The admin can edit and delete pre-existing tax classes.

- While adding new tax classes admin can label it with a suitable name.

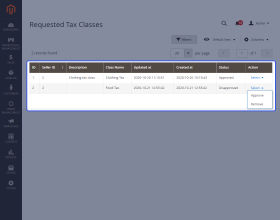

Approve New Tax Class Requests

The admin can manage all the tax class requests instantly and has the access to approve it.

- The admin can approve or remove the requested tax class from the seller.

- Seller ID helps in checking the requested tax class easily.

- Date of creation and last updated keeps the admin updated about all the tax class requests

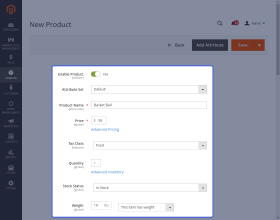

Implement AvaTax on Magento Products

The admin can directly apply a tax class to the product.

- Choose a product from the list on which tax class is to be levied.

- Anytime set the tax class for a product and enable it.

- Can change the applied tax class with another as per requirements.

- Applied tax class is reflected in the front end during purchase.

Map Marketplace Seller Products with Avalara Sales Tax

Sellers can directly apply the tax class approved by the admin on their products.

- Sellers can choose any product from the list on which tax class is to be set.

- Tax levied by the seller will be applicable to the seller’s product.

- The set tax class for a product can be changed at any time.

- Applied tax class is visible to the buyers when they add a product to the cart.

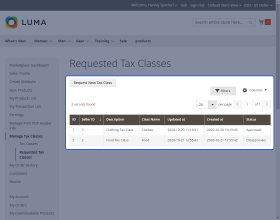

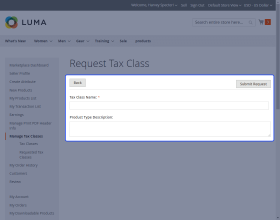

New Tax Class Seller Request

The sellers have the liberty to request tax classes from the admin.

- Sellers can check all the tax classes created by the admin along with the tax code and description of the tax classes.

- Sellers can check the status of his/her requested tax classes.

- Submit a request to admin create a tax class with its name and product type description.

- The requested tax class is instantly reflected on the admin panel.

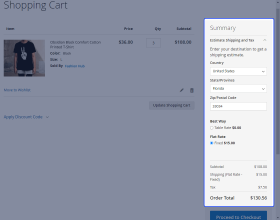

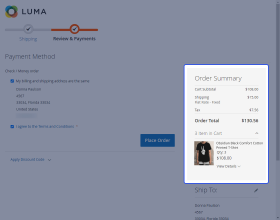

Estimate Accurate Tax Information with Avalara

Whenever a customer makes a purchase tax will be applied to the products, based on their shipping address.

- Imposed tax is visible when the buyer adds the products into his/her shopping cart.

- Customer needs to enter their destination to get a shopping estimate of the order.

- The customer’s zip/postal code determines whether the tax class will be applied or not.

- Calculated tax is visible on the checkout page as well.

Support

For any query or issue please create a support ticket here http://webkul.uvdesk.com/.

You may also check our quality Magento 2 Extensions.

Specifications

Frequently Asked Questions

Move to Cloud Today

AWS Free tier hosting for one year by amazon web services, for more details please visit AWS Free Tier.

GCP Free tier hosting for one year with 300 credit points by google cloud platform, for more details please visit GCP Free Tier.

Azure free tier hosting for one year with 25+ always free services, for more details please visit Azure Free Tier.

In our default configuration we will provide tremendous configuration for your eCommerce Website which is fast to load and response.

Default Configuration Details of Server

- 1 GB RAM

- 1 Core Processor

- 30 GB Hard Disk

- DB with 1 GB RAM and 1 Core Processor

* Server Configuration may vary as per application requirements.

Want to know more how exactly we are going to power up your eCommerce Website with Cloud to fasten up your store. Please visit the Cloudkul Services.

Get Started with Cloud- + Features

- - Bugs

- + Compatible with Magento ^2.4.7

- + Add Avalara avatax tax calculations support to Multi Shipping.

- + Added GraphQl support

- - Fixed UI issue for create and edit tax classes at adminend.

- - Fixed issue with tax calculations when cart contains both admin and seller products.

- + Added features for mass delete at admin end

- + Seller can delete requested class from his/her end.

- + Added validation to prevent the deletion of the tax classes when used by the products.

- - Fixed issue where tax was not applied to configurable products.

- + Compatible with Magento ^2.4.7

- + Add Avalara avatax tax calculations support to Multi Shipping.

- + Added GraphQl support

- - Fixed UI issue for create and edit tax classes at adminend.

- - Fixed issue with tax calculations when cart contains both admin and seller products.

- + Compatible with Marketplace ^4.0.2

- + Compatible with Magento ^2.4.1

- + Compatible with Marketplace ^2.3.0

- + Enable/disable avalara avatax from admin panel.

- + Calculate tax on cart page as well as checkout page using Avalara avatax.

- + Checks for valid shipping address.

- + Admin can create product tax classes with avalara tax codes.

- + Seller can see tax classes on his/her end.

- + Seller can request for a separate tax class with tax code from his/her end.

- + Admin can approve/disapprove tax class request.

- + Compatible with Marketplace community edition 2.0.* and Magento community edition 2.1.

- + Enable/disable avalara avatax from admin panel.

- + Calculate tax on cart page as well as checkout page using Avalara avatax.

- + Checks for valid shipping address.

- + Admin can create product tax classes with avalara tax codes.

- + Seller can see tax classes on his/her end.

- + Seller can request for a separate tax class with tax code from his/her end.

- + Admin can approve/disapprove tax class request.