Woocommerce Marketplace Avalara Tax Integration

WooCommerce Marketplace Avalara Tax Integration plugin lets admins and vendors create product tax classes with Avalara tax codes, allowing customers to view tax based on their address.

- Supports tax calculation based on Avalara Tax codes for India and the USA.

- Both admin and sellers can add products and assign Avalara Tax codes.

- Tax rates vary based on the billing address.

- Verifies the validity of the shipping address.

- Admins and sellers can view tax classes on their respective dashboards.

This plugin is now compatible with Cart and Checkout blocks and High-Performance Order Storage (HPOS).

- Description

- Reviews

- FAQ

- Customers ()

- Specifications

- Cloud Hosting

- Changelog

WooCommerce Marketplace Avalara Tax: Integrate Avalara Tax into WooCommerce Marketplace for precise tax calculations. Admins and sellers can set product tax classes with Avalara codes, allowing customers to view taxes based on their address.

Help store owners sell worldwide with automated cross-border tax calculations for different regions. Import real-time taxes at checkout for accurate collection.

Note - This plugin is an add-on of WooCommerce Marketplace. So to use this module you have to install Multi Vendor Marketplace for WooCommerce.

Highlighted Features

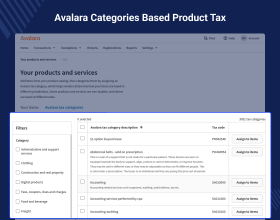

Admin & Vendor Tax Code Management

Both admin and vendors can add and edit product tax codes from Avalara.

Location-Based Tax Calculation

Taxes are applied based on the shipping address of the order.

Country-Specific Tax Rules

Admin can select specific countries where Avalara tax rules will apply.

Real-Time Tax Calculation

Ensures accurate tax rates at checkout based on Avalara tax codes.

Why Do We Need WooCommerce Marketplace Avalara Tax?

WooCommerce Marketplace Avalara Tax module automatically updates tax changes from the government, ensuring your store stays compliant. Store owners don’t need to worry about tax rules.

Handling tax calculations for global sales can be difficult because tax rules differ by country and region. Frequent government policy changes can also pose risks and lead to penalties.

Apart from that, you can check WooCommerce Marketplace Tax Manager which allows admins and vendors to manage order taxes seamlessly.

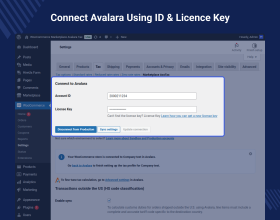

Integrate WooCommerce Marketplace with Avalara

The admin must enter the Account ID and License to connect with Avalara.

- For transactions outside the US, the admin must enable Sync.

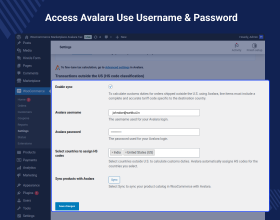

- To access Avalara, the admin needs to log in using the Avalara password.

- Avalara automatically assigns the HS code based on the selected country.

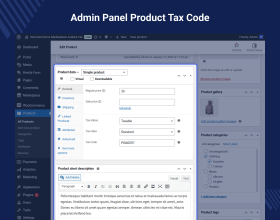

Admin Panel Tax Code Management

Admin can update the product description in the product edit section.

- Set regular price, sale price, tax status, tax class, and tax code.

- Manage inventory and shipping details.

- Add and update product data from the edit product section.

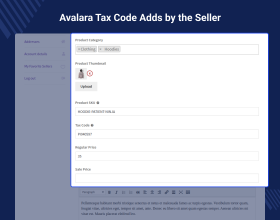

Avalara Tax on Seller Products

Seller can manage the product on the storefront by adding the product details and tax code from Avalara tax.

- Can add and edit the product tax code anytime.

- The tax code is visible to users when the product is added to the cart.

- The tax code set by the seller applies only to their products.

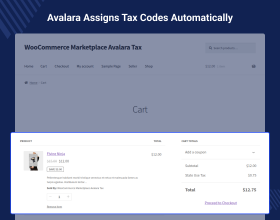

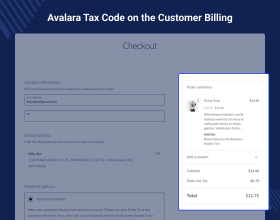

Get Precise Tax Estimates with Avalara

Taxes are applied to products based on the customer's shipping address at the time of purchase.

- The applied tax is displayed when the buyer adds products to the shopping cart.

- Customers must enter their destination to receive a shipping estimate for the order.

- The tax class is determined by the customer's zip/postal code.

- The calculated tax is also displayed on the checkout page.

Support

For any query or issue, please create a support ticket here http://webkul.uvdesk.com/

You may also check our quality WooCommerce Plugins.

Specifications

Frequently Asked Questions

Move to Cloud Today

AWS Free tier hosting for one year by amazon web services, for more details please visit AWS Free Tier.

GCP Free tier hosting for one year with 300 credit points by google cloud platform, for more details please visit GCP Free Tier.

Azure free tier hosting for one year with 25+ always free services, for more details please visit Azure Free Tier.

In our default configuration we will provide tremendous configuration for your eCommerce Website which is fast to load and response.

Default Configuration Details of Server

- 1 GB RAM

- 1 Core Processor

- 30 GB Hard Disk

- DB with 1 GB RAM and 1 Core Processor

* Server Configuration may vary as per application requirements.

Want to know more how exactly we are going to power up your eCommerce Website with Cloud to fasten up your store. Please visit the Cloudkul Services.

Get Started with Cloud- + Features

- - Bugs

- Initial Release