WooCommerce Marketplace Tax Manager

It allows the admin as well as the vendors to manage tax for their orders.

- The order tax amount will credit either to the admin or seller as defined by the admin.

- The seller can also define the tax rate for their products.

- Sellers can create a CSV file of locations based on Post/Zip Code and import them

- A create tax table row can be deleted by the seller.

- Description

- Reviews

- FAQ

- Customers ()

- Specifications

- Cloud Hosting

- Changelog

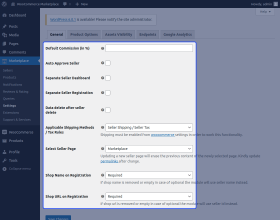

WooCommerce Marketplace Tax Manager: This plugin allows a feature to apply the configured seller/admin tax amount for marketplace seller/admin orders. The admin may allow the seller to configure and manage the tax rule for their orders. Once an order is made by the customer the tax amount will be credited to the seller if enabled for seller else to admin.

Apart from that, the seller can define the tax rate which will apply on order. The seller can even create the CSV file of locations based on Post/Zip Code and import them into WooCommerce Marketplace.

Note - This plugin is an add-on of WooCommerce Marketplace. So to use this module you have to install Multi Vendor Marketplace for WooCommerce.

Highlighted Features of WooCommerce Marketplace Tax Manager

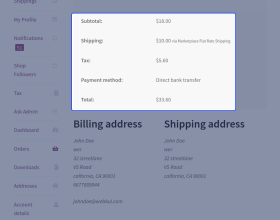

View Tax details

The seller can view the applied tax amount details for an order.

Define Tax Rates

With this module, the seller can enter the tax rate in percentage.

Tax Name

This module allows the seller to enter the name of Tax example VAT

Deleting Tax Rates

If you entered the incorrect tax rates then the seller can delete a particular tax rate.

Why use this plugin?

Sales tax rates can vary by state and locality as per different types of products and it becomes a huge headache when you’re trying to figure out how much sales tax to charge your customer for your marketplace orders which include seller tax as well. To manage a seller tax based on their products and location is quite complex for admin.

To make the tax process easier we put together this addon for WooCommerce marketplace sellers who need a better way to manage tax rates for different locations for their own products so that each seller sales tax collected in your WooCommerce seller panel. The customers can see the tax amount at checkout that is applicable to the product as well seller can see tax details from their seller panel applied on order.

Enable Each order Tax Amount for admin/seller

Before starting a marketplace store, setting up taxes and tax rates is the first step you must perform.

This module allows admin to give access for the seller to define the tax rate and required settings, that configured tax amount will apply to marketplace orders on each sale.

- The admin can enable the seller to manage the tax rate for their orders.

- The order tax amount will credit either to the admin or seller as defined by admin.

- This module will help to resolve additional admin Sales Tax responsibility.

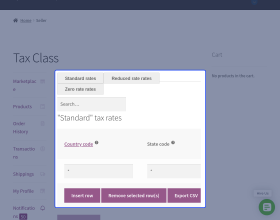

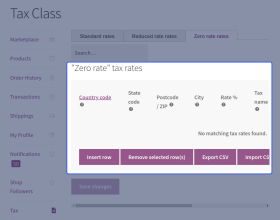

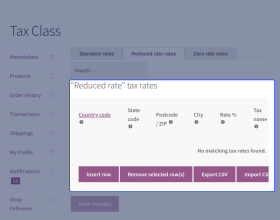

Apply Standard/Reduced/Zero Tax Rates Manually

The seller can create the Standard/Reduced/Zero Tax Rates on the purchased order. Creating a tax can be complex for sellers but this module provides a better experience to apply tax rates effortlessly.

This option is only visible if taxes are enabled for sellers. Each tax rate will include the below attributes:

- Country, state, zip/postcode

- Name of Tax

- The tax rate in percentage

- Specify a different priority per rate.

- Apply to Compound and shipping

Export Tax Rates in CSV by Seller

This module also provides an additional feature that will help to export tax rate data in CSV files to the seller. This module provides an easy and fast way to create a tax rate.

This CSV file contains country code, state code, postcodes, cities, rate, tax name, priority, compound, shipping field.

The seller can use the export button to export the CSV file and make the changes and upload it if need to update bulk tax rate data via CSV.

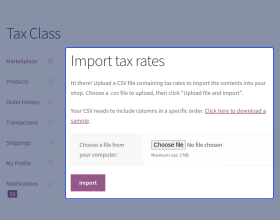

Import Tax Rates in CSV by Seller

If the seller has the tax data in bulk like having a list of locations and want to add in the tax rate. Then, the seller can use the Import CSV button to import multiple tax table rates.

- The CSV file for importing requires these columns - country code, state code, postcodes, cities, rate, tax name, priority, compound, shipping field.

- The seller can also download the sample CSV file and import it into the WooCommerce marketplace store.

- The seller can also search tax rate by tax name from their panel

Manage Tax Zones & Rates

With this module, the seller can apply tax settings in the form of tax rates and address.

- Once the tax rate is updated by the seller, your store will collect the sales tax at checkout based on your defined store address to the seller.

- The seller’s configured tax will be applied to WooCommerce orders if enabled as a seller.

- The admin configured tax will be applied to WooCommerce orders if enabled as admin

- For instance, if the seller tax is selected and the order made for different seller’s products then tax will credit to each seller according to their configuration.

Support

For any query or issue, please create a support ticket here http://webkul.uvdesk.com/

You may also check our quality WooCommerce Plugins.

Specifications

Frequently Asked Questions

Move to Cloud Today

AWS Free tier hosting for one year by amazon web services, for more details please visit AWS Free Tier.

GCP Free tier hosting for one year with 300 credit points by google cloud platform, for more details please visit GCP Free Tier.

Azure free tier hosting for one year with 25+ always free services, for more details please visit Azure Free Tier.

In our default configuration we will provide tremendous configuration for your eCommerce Website which is fast to load and response.

Default Configuration Details of Server

- 1 GB RAM

- 1 Core Processor

- 30 GB Hard Disk

- DB with 1 GB RAM and 1 Core Processor

* Server Configuration may vary as per application requirements.

Want to know more how exactly we are going to power up your eCommerce Website with Cloud to fasten up your store. Please visit the Cloudkul Services.

Get Started with Cloud- + Features

- - Bugs

- Fixed: Compatible with WooCommerce 8.1

- Fixed - Seller tax is adding an extra amount issue.

- Fixed - Tax menu is redirecting on Seller Admin Dashboard Panel issue.

- Fixed - Functionality and security issues.

- Updated - Code structure according to WordPress and WooCommerce coding standards.

- - Updated readme, pot files.

- - Updated code structure.

- - fixed security issues.

- - Fixed phpcs issues and improved coding standard

- - Compatibility with Webkul Marketplace version 5+

- - WPCS issues

- + Initial release