Top Selling Extension Winner

2 times in a row

Magento 2 Multi Vendor GST Tax

Magento 2 Multi Vendor GST Tax extension allows the admin and the marketplace seller to configure their GSTIN number and select their region.

- The admin can enable the module for the seller.

- Both the admin and the seller have to specify the GSTIN number.

- The admin/sellers can upload the CSV file of the GST rate of all products.

- The admin/sellers can decide the GST rate in percentage per product.

- The admin and the seller can set the HSN code per product-wise.

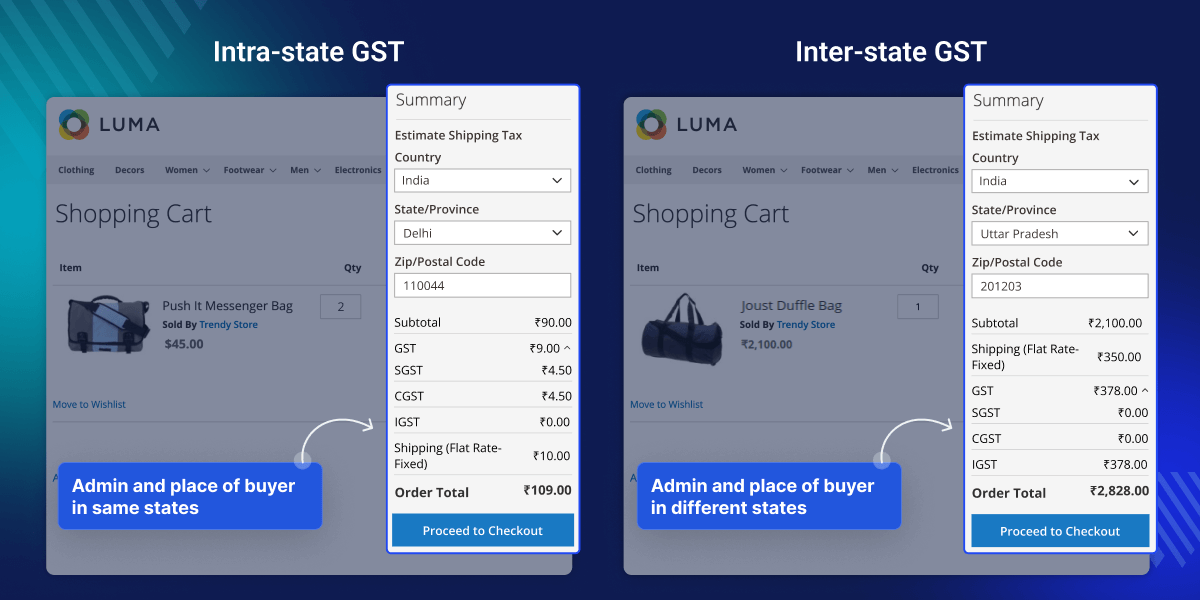

- GST rates display in shopping cart, and for the same state, the SGST & CGST will apply.

- For different states from the store owner, the IGST will apply.

- The HSN code will be displayed on the invoice of the order.

- Customers can add their own GST Number & GST info. is displayed in emails & PDF’s.

- GraphQL has been implemented for the extension.

- The extension is compatible with the Hyva Theme.

Top Selling Extension Winner

2 times in a row

Note: For Marketplace GST to apply, there must be the “Taxable Goods” option selected in the product’s TAX class.

- Description

- Reviews

- FAQ

- Customers ()

- Specifications

- Cloud Hosting

- Changelog

This Adobe Commerce extension facilitates the admin to set up the Indian GST structure in the eCommerce Store for the automatic alignment of all tax operations as per the new GST standards. With the help of this extension, the admin and the seller both can configure their GSTIN number and select their region.

They decide the GST rate in percentage per product while creating it. Also, they can decide the GST rate during the discount of the product and the admin can upload the CSV file of the GST rate of all products. The GST will apply to the shopping cart. Also, check out Magento 2 Marketplace Avalara Tax for automating calculations based on the regions.

Please Note - This is a marketplace add-on, so you need to install Webkul's Magento 2 Marketplace Module first.

Highlighted Features

Set Up GST Tax On Webstore

Admin and seller can set up the Indian GST structure in the Magento eCommerce Store.

Automatic GST Tax Alignment

Allows admin and seller for the automatic alignment of all tax operations as per the new GST standards

Configure GSTIN

Admin and seller can configure GSTIN or Goods and Service Tax Identification Number, which has replaced the Tax Identification Number (TIN).

GST Assignment On Product Page

Using this GST Tax extension admin and seller can implement the GST on product page

Mass Update GST CSV

The admin and the seller can mass update the GST rates of the products through the CSV file

Customer End GST Display

The E-commerce Marketplace GST Extension facilitates the customer to update the GSTIN in the Address Book

Hyva Theme Compatible

The extension is fully compatible with the Hyva Theme.

GraphQL Implementation

GraphQL has been implemented for the extension.

What is GST?

GST implies Goods and Service Tax and it is an indirect tax levied on the supply of goods and services. GST act came in effect from 1st July 2017. GST has replaced many Indirect Taxes in India. It implies the fact of One Nation, One Tax and it replaces all types of taxes with a single tax. GST helps to remove the cascading tax effect and regulate the unorganized sector.

Importance of GST in eCommerce

For commencing business as a marketplace model of eCommerce, all eCommerce operators are required to be registered under GST. So also for Magento eCommerce store owner, it is required to register under GST as all Indian store owners must implement it.

Why do we need Multi-Vendor GST Tax for the Magento 2 module?

GST India Marketplace Add-On facilitates the admin and seller to set up the Indian GST structure in the eCommerce Store for the automatic alignment of all tax adjustments as per the new GST standards. Tax alignment as defined in the configuration will automatically take place based on the production state of the admin or seller and the delivery state of the buyer.

In the e-commerce marketplace updating, GST manually is not easy which is why the GST India Marketplace Add-On allows the admin and seller to upload the CSV file of the GST rate of all the products and services in one go.

Also, they can decide the GST rate in percentage per product while creating it and the GST rate during the discount of the product. The GST will apply to the shopping cart.

Also, if you are running a single seller store on Adobe Commerce and want to add the GST feature to the same, check the Magento 2 GST extension.

GSTIN in eCommerce

GSTIN is a state-wise PAN-based 15-digit Identification Number which has been allotted to every taxpayer. The eCommerce store owner must have their GSTIN number, which they will get after the registration. The same will be used during the configuration of this module.

Set Goods and Services Tax Identification Number

- The admin and seller can set the GSTIN which has been allotted to every taxpayer.

- The admin can enter the GSTIN for the configuration of the GST extension.

- The seller can enter the GSTIN for the configuration of the GST extension.

- GSTIN - Goods and Services Tax Identification Number.

- GSTIN is a state-wise PAN-based 15-digit Identification Number.

Set Up GST Tax On Webstore

In the multivendor marketplace, many vendors come across different states and sell their products on your website. Also, in the eCommerce business, things are changing rapidly and in between this, meeting the compliances of eCommerce is very important for the operators.

With the help of this module, each of them doesn't need to be well educated and aware of the GST.

- The admin to set up the Indian GST structure in the Magento eCommerce store for the automatic alignment of all tax operations as per the new GST standards.

- Set GSTIN (Goods and Service Tax Identification Number).

- The admin and the seller both can enter the Production State as it plays a vital role in GST calculation.

Automatic GST Tax Alignment

After the integration of the GST, the main part that comes up is to calculate the taxes. So this module solved that too Based on the production origin of the admin or the seller and the delivery destination of buyers GST Tax extension implements the tax automatically.

- The tax gets automatically aligned for intra-state supply.

- Also, for the inter-state supply, the tax gets automatically aligned.

- The customers can see the total tax applied and its breakdown on the shopping cart page.

- The customers can see the state-based tax calculation.

- It creates a sense of transparency between the customers.

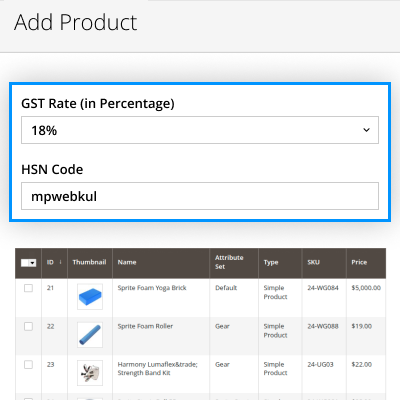

Implement GST On Product Page

Using this Multi Vendor GST Tax module for Magento 2, the admin and the marketplace seller can implement the GST on the product. The process is very easy, both can see all the required fields related to the GST on the product edit page.

The fields encounter by them while implementing the GST on the product are:

- GST Rate (in %) - They can easily define GST Rate (in Percentage).

- The admin and seller can set the HSN Code “Harmonized System of Nomenclature” for that particular product.

Mass Update GST CSV

As it is human nature that we always seek the easy way of anything. The store owner and the marketplace sellers find it quite tedious to add the tax rate to every product. Hence the module gives the advantage to the store owner and the sellers to add GST rate collectively.

With the help of Mass Upload CSV, the admin and the seller both can add details of the product inclusive of the GST rate in a CSV file and upload it.

- This saves time for the store owner and provides ease of work.

- GST rate can be uploaded in one go, no individual update is required.

- The admin and the marketplace seller both can mass update the GST rates of the products through the CSV file.

Customer End GST Display

The marketplace customers can view the applied GST in the frontend. The customer can view the rate of GST in various sections. But before that, they need to update the GSTIN in their Address Book.

- Customers can set the GSTIN in their address book and the calculation is done based on the location.

- The customer can view the GST rate in the shopping cart, at the time of checkout, and in the invoice of the order.

- There is a split in the GST rate depending on the address.

- Herein, the GST rates are divided among CGST and SGST for intrastate. However, IGST is implemented in the case of inter-state.

Complete Features List

- They can select their production state.

- Option to set the GST rate per product.

- The admin and the seller can mass update the GST rates of the products through the CSV file.

- The GST rates will display at the shopping cart page.

- For the same state, the SGST and the CGST will apply.

- Customers can add their own GST Number in Create Account Page and Customer Edit Page.

Support -

For any issue related to this module, please create a support ticket here at - https://webkul.uvdesk.com/en/customer/create-ticket/ or send an email to support@webkul.com

You may also check our quality Adobe Commerce Extensions.

Specifications

Frequently Asked Questions

Move to Cloud Today

AWS Free tier hosting for one year by amazon web services, for more details please visit AWS Free Tier.

GCP Free tier hosting for one year with 300 credit points by google cloud platform, for more details please visit GCP Free Tier.

Azure free tier hosting for one year with 25+ always free services, for more details please visit Azure Free Tier.

In our default configuration we will provide tremendous configuration for your eCommerce Website which is fast to load and response.

Default Configuration Details of Server

- 1 GB RAM

- 1 Core Processor

- 30 GB Hard Disk

- DB with 1 GB RAM and 1 Core Processor

* Server Configuration may vary as per application requirements.

Want to know more how exactly we are going to power up your eCommerce Website with Cloud to fasten up your store. Please visit the Cloudkul Services.

Get Started with Cloud- + Features

- - Bugs

- + Compatible with magento 2.4.7 and php 8.3

- - Fix translation issue.

- + Added GRAPHQL API.

- + On customer order page GST breakdown.

- + Seller can see GST breakdown on their order page.

- + GST breakdown on the email for order confirmation to the customer.

- + Implemented Grid for Uploaded data from the csv.

- + Implemented Grid at the GST upload option page.

- + Added option of implement Exclusive and include tax in admin end.

- - Corrected spellings and Updated the heading while uploading the GST csv.

- - Fix special characters in GSTIN field validation.

- - Fix GST field for US or other countries than INDIA

- - Fix HSN number in order invoice.

- + Version upgrade for Magento 2.4.x

- + Compatible with Marketplace 5.*.* version.

- + Compatible with magento 2.4.7 and php 8.3

- - Fix translation issue.

- - Compatibility with MPSellerCoupon module

- - Fix for Credit memo and Invoice PDF layout

- + Added GRAPHQL API.

- + On customer order page GST breakdown.

- + Seller can see GST breakdown on their order page.

- + GST breakdown on the email for order confirmation to the customer.

- + Implemented Grid for Uploaded data from the csv.

- + Implemented Grid at the GST upload option page.

- + Added option of implement Exclusive and include tax in admin end.

- - Corrected spellings and Updated the heading while uploading the GST csv.

- - Fix special characters in GSTIN field validation.

- - Fix GST field for US or other countries than INDIA

- - Fix HSN number in order invoice.

- + Compatible with Magento 2.4.x and Marketplace 4.*.*.

- + Version upgrade for Magento 2.3.x

- + Compatible with Marketplace 3.*.* version.

- + Version upgrade for Magento 2.2.x

- + Compatible with Marketplace 2.3.* version.

- + Normal Tax is applicable for other than India.

- + Min/Max GST feature added.

- + Admin can Enable/Disable the module any time.

- + Admin can add GST percent and HSN code product wise.

- + Admin can set Production State.

- + Seller is able to set the GST percent and HSN code for their products.

- + Seller can set own Production State.

- + Products GST percent and HSN code Mass Update feature is available for both seller and admin.

- + GST is applied according to per product.

- + GST is categorized in SGST, CGST, and IGST.

- + Customers can add own GST Number on the Customer Address Page.

- + GST info is displayed in emails and PDFs.